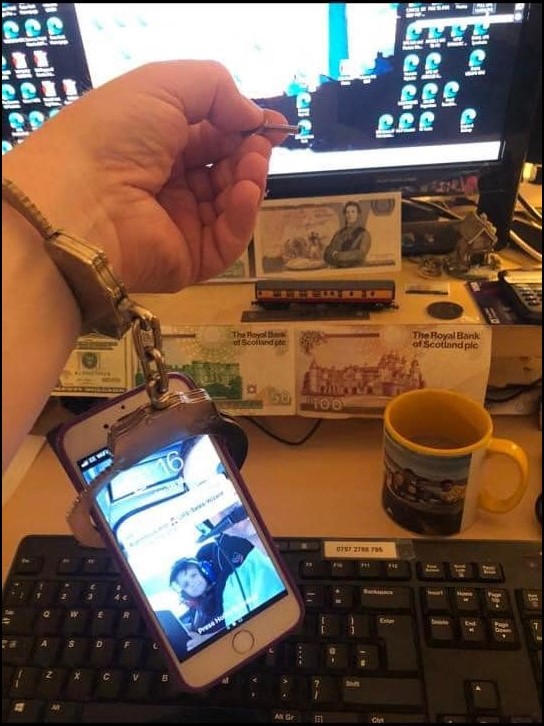

Royal Bank of Scotland

Big Mess, Small Mess – The UK’s Worst Bank?

On 9th October 2017, the Royal Bank of Scotland sent a text demanding this website telephone them on 0345 600 2230.

Text Allegedly From RBS

On telephoning the Royal Bank of Scotland’s questionable phone number, an automated answering system required us to input out account user ID and other private information for “security purposes”. Unhappy with this intuitively wrong situation – giving away private account information, eventually we managed to penetrate the dense jungle like-quagmire of RBS telephone: “press button 1 for this” guff to reach a human . Namely “Keiren”. Almost an hour later, with several periods interminably on hold, Keiren could not help unless we gave her our private RBS internet banking username and access codes.

As a former police officer I believe this to be from either a fraudster, illegally phishing for private account information, or the Royal Bank senior management have taken leave of their senses. Royal Bank of Scotland’s specific guidelines warn against exactly what the text as per the apparent RBS screenshot reproduced above and what “Keiren” was aiming to access – our online login details and related information. Contrary to explicit RBS advice.

Illegitimate RBS Conduct – Or Fraud. You Guess Which?

For a legitimate bank to text customers and then ask for private username ID and codes is incompetent and bad practice. It encourages genuine fraudsters!

So what was the response of RBS? By now, well over an hour on hold with the RBS/Phisher called Kieren and her defective banking system and non-functioning friends in another RBS department who could help – but only if we gave our password username and ID access codes. In the end, she was unable to help in any way due to “very high demand from customers”. Perhaps that was because she has no access to anyone from RBS and this was a fraud?

Then a series of subsequent non productive calls to try and establish the legitimacy of this pain in the neck text from RBS – following the 11.35am timed text (or more accurately the apparent phishing text) and a series of obstacles created by RBS to obstruct filing complaints, out of utter frustration the reply text from ourselves was sent…

Surprise! The RBS Number Was Unable To Receive Inbound Texts.

Something Phishy Smells This Way

Eventually, exasperated at the obstructive complaints system at RBS we contacted their press department. A somewhat disinterested chap made a decidedly lackluster and limp effort to dodge this and pap the wasted hour and a half of our day across to the RBS complaints department. That would be the notorious RBS complaints service that doesn’t answer their phones and tries every trick in the book to avoid complaints being filed.

Sorry PR Whizz Kid, but this is your problem. Your bank is an utter PR disaster. Whether small PR or big PR – your bank is a disreputable mess. With respect, you and your colleagues at RBS PR are paid to care about reputational damage.

I’m off to buy £20 of RBS shares.

The RBS PR Department + Complaints Department Suck.

The next RBS AGM seems the best arena to raise this. As a shareholder at least the CEO of RBS has to listen.

Our own website which has suffered due to RBS Texting malpractice.

It is a reasonable thesis that when you work for such a PR disaster prone bunch of crooks unfit to hold a banking licence, then as one of their PR gurus, you may well feel like throwing in the towel…

RBS Dash For Cash Scandal. MP Invokes Serious Fraud Office Criminality Inquiry

Yes, and several of these miscreant executives still hold banking licences after stealing from people and ruining their lives.

Our view? Senior officials should be charged with theft after the RBS Dash For Cash scandal.

Click Here For Police Scotland + RBS News

Current RBS chief executive Ross McEwan appears not to be worth the $7,000,000 plus perks he is paid each year. That is a pay packet of $95,890 each week! Who on earth is worth that? Someone who presides over a loss of £4.082 BILLION for just one year of Mr McEwan being at the helm?

This bank has been malfunctioning for a decade and the majority shareholders are you. The taxpayer (you) own 73% of RBS (here). So you are paying Ross the loser to throw away enough of your money each week to build a brand new hospital – every week. What could your community do with a £78,000,000 hospital? That’s a fact. The taxpayer is allowing this incompetent bank to continue – 10 years after the banking crash, to burn through taxpayer cash and throw a wage at Ross McEwan that is tantamount to a national disgrace. To continue the hospital analogy, Ross McEwan is paid more in 1 day than an NHS nurse is paid in 365 days.

Personally Ross McEwan is NOT a loser. He is a very clever man. Very slick at his job. Getting you to pay him $19,000 each and every day to lose £11,118,000 pounds of your money each and every day. The Midas touch with Merde as a result!

RBS CEO Ross McEwan Trousering $7 Million A Year For Losing Nigh on £7 BILLION A Year!

We know not what jolly financial japes Mr McEwan and his banking friends are up to next in RBS Dash For Cash The Sequel, but he ruined a couple of hours out of my day today. Over an account that has been handled impeccably since being opened 11 years ago. I should have been writing for Unique Property Bulletin – helping you. Instead, like many others, the deathly avaricious grasp of RBS boney fingers creeping towards your wallet or purse has caused upset and loss of time that can never be recovered. Could be worse. We just lost a few hours, whereas RBS Dash For Cash have bankrupted good and decent people and thrown their employed out on the streets.

What do you reckon to RBS?

Should their senior management go to jail?

Should they stop their “Dash For Cash” style of banking?

Big or Small RBS Screws It All.

RBS rely on the inability of ordinary people to call them to account. Well this may just be one webpage, but we have 70,000 readers, so I would ask each and every one of our readers to let their family and friends know the truth that this decade old corporate greed and RBS reiverey is still going on. A corporate disgrace. A thieving gravy train that shows no signs of the fat cats getting off of their free ride anytime soon.

As for today’s pain in the neck – RBS could start by ceasing and desisting with the phishing style texts. Especially in the current era of wholesale attack on customer accounts by internet fraudsters.

We would ask readers to call us on 0793 557 2803 if they have had a similar nightmare day inflicted by bungling CEO McEwan and his loss making Juggernaut?

==================================

Reference from RBS Group accounts…

RBS reported an operating loss before tax of £4,082 million for 2016 and an attributable loss (1) of £6,955 million, which included litigation and conduct costs of £5,868 million, restructuring costs of £2,106 million, the final Dividend Access Share (DAS) dividend of £1,193 million and Capital Resolution disposal losses and impairments of £825 million. Restructuring costs included a £750 million provision in respect of the 17 February 2017 update on RBS’s remaining State Aid obligation regarding Williams & Glyn. An operating loss before tax of £4,063 million and an attributable loss of £4,441 million were reported in Q4 2016.

Source: Click Here.